Why is US Oil Consumption Lower? Better Gasoline Mileage?

Posted on

January 31, 2013 by

Gail Tverberg

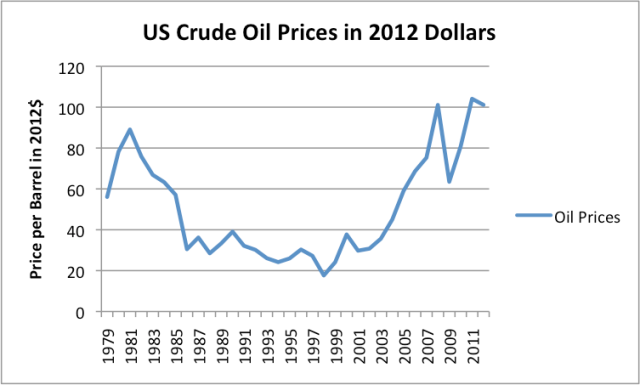

United States oil consumption in 2012 will be about 4.7 million barrels a day, or 20%, lower than it would have been, if the pre-2005 trend in oil consumption growth of 1.5% per year had continued. This drop in consumption is no doubt related to a rise in oil prices starting about 2004.......

A small part of the decline in oil consumption comes from improved gasoline mileage. My analysis incidates that about 7% of the reduction in oil use was due to better automobile mileage. The amount of savings related to improved gasoline mileage between 2004 and 2012 brought gasoline consumption down by about 347,000 barrels a day. The annual savings due to mileage improvements would be about one-eighth of this, or 43,000 barrels a day.....

Apart from improved gasoline mileage, the vast majority of the savings seem to come from (1) continued shrinkage of US industrial activity, (2) a reduction in vehicle miles traveled, and (3) recessionary influences (likely related to high oil prices) on businesses, leading to job layoffs and less fuel use.